Spreads on major forex pairs start from 0.0 pips

Commissions that allows traders to take advantage of the markets

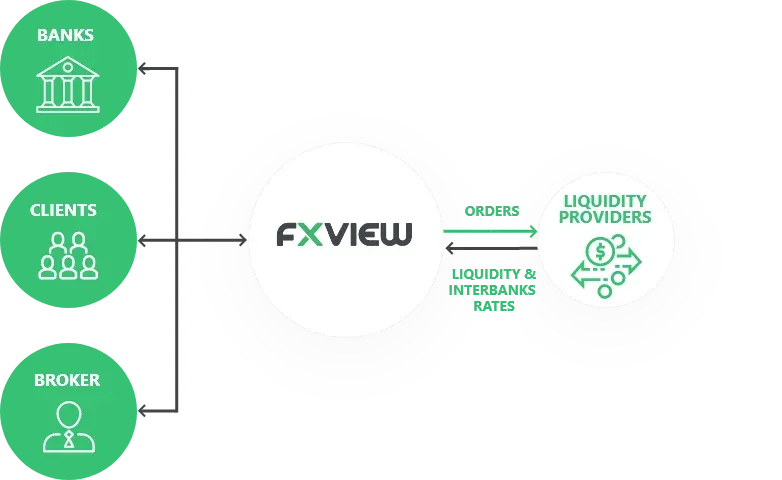

Gain access to deep liquidity & enjoy the best bid/ask prices

Open an account in less than 5 minutes. Start trading your way.

At Fxview, we offer dynamic leverage, thus allowing our clients to trade with higher leverage. However, depending on the volume you trade, the leverage level adjusts accordingly. A higher volume automatically triggers a lower leverage level. The tables below show the leverage you will trade with, depending on the total number of open lots.

EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, AUDCAD, EUDCAD, EURGBP, EURJPY, GBPCAD

EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, AUDCAD, EUDCAD, EURGBP, EURJPY, GBPCAD

Note: In case you have opposite open trades in the same instrument (i.e. hedging trades), margin will only be required for your net open position (total lots long – total lots short). See example 6 for more information.

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Client Account Leverage: 500X

Consider a USD account with 3 Buy (or Sell) lots of USDCAD. In this example, the account’s leverage (1:500) is equal to the instrument’s leverage (1:500), so the margin required would be:

Open an account in less than 5 minutes. Start trading your way.

The table below lists the opening and closing times for various instruments across different asset classes, expressed in our server time.

Open an account in less than 5 minutes. Start trading your way.

Oceax is a leading online trading platform that provides access to a wide range of global financial instruments, including forex, cryptocurrencies, stocks, indices, and commodities.

Oceax is a registered company incorporated in [Your Location], with company number [Company Number]. The registered office is located at [Your Address].

RISK WARNING: Trading on margin, especially in forex and other financial instruments, carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work both for and against you. Before deciding to trade, carefully consider your investment objectives, experience level, and risk tolerance. There is a possibility that you could lose some or all of your initial investment, so you should never invest money that you cannot afford to lose. Be sure to understand all the risks involved and seek advice from an independent financial advisor if needed.

RESTRICTIONS: Oceax does not offer its services to residents of certain jurisdictions, such as the United States, Singapore, China, North Korea, and other regions on the FATF, OFAC, and EU/UN sanctions lists.

Oceax does not direct its website or services to individuals in countries where the use of its website and services is prohibited by local laws or regulations. When accessing this website from such jurisdictions, it is your responsibility to ensure that your use of the site complies with local laws and regulations.

Oceax does not affirm that the information on its website is suitable for all jurisdictions.